Throughout history, societies have progressed by the discovery and commercialization of various materials. From stone to copper to bronze to iron to steel to plastic and most recently, silicon, human beings have been able to raise their living standards as a result of the discovery and development of useful materials. And now the application of nanotechnology is given a huge boost with the emergence of HydroGraph Clean Power’s patented and commercial ready technology that produces 99.8% graphene, a nano material. HydroGraph Clean Power (HydroGraph) is the only company in the graphene industry that can consistently produce what is essentially pure graphene and do it less expensively than its competitors, which at best are unable to manufacture a product that exceeds 50% graphene. Because of the economics and characteristics of pure graphene that are essential for dozens of industries, including some of the biggest industries in the world, I think graphene may become one of the leading nano materials in the world with HydroGraph as the first mover.

I am very privileged to have some very smart subscribers to my newsletter. One of them is a nuclear engineer named Kerry Landis, who after serving the Navy in that capacity, has spent his career in examining nuclear power plants across the U.S. Accordingly, his professional life has led him to be focused like a laser on developments in the world of materials science. That is how he discovered HydroGraph, which he began investing in four years ago. Realizing that the company is now on the cusp of explosive growth, he was kind enough to contact me, to spend a considerable amount of time with me to tell me the story. I’m not turning negative on gold miners by any means. But I think HydroGraph is a story you don’t want to miss, for reasons I hope will become clear to you as you read this report.

An Accidental Discovery by Dr. Chris Sorenson at KSU

The HydroGraph story has its origins in 2014 when Dr. Chris Sorenson at Kansas State University accidentally discovered a means to produce pure graphene by explosion. He was studying aerosol gels when a spark connected with acetylene inside a chamber and resulted in the production of pure graphene. Seeing the potential for this discovery, a patent was filed. HydroGraph now holds three patents for this process of producing 99.8% graphene and has filed another eight patents that are pending mostly for application of graphene for commercial use. HydroGraph is now in the position of being the only company that produces pure graphene and with costs far lower than any competitor. The ability to consistently produce pure graphene sets HydroGraph apart from its competitors because delivery of a consistently high-quality graphene is essential in developing commercial applications. And reportedly, HydroGraph is well on its way to doing so in the auto and plastics industries.

The Hyperion machine shown above is the patented device that HydroGraph uses to produce 99.8% “pure” graphene, defined as such because it is 100% crystalline and 100% sp2 bonded. The unit measures 2 meters by 2 meters by 12 ft. in height. An invisible gas (acetylene) is pumped into the black chambers inside the Hyperion unit. A spark from an electrode sets off an explosion that raises temperatures within the black chambers to 2,500 degrees Kelvin. That rips apart the carbon molecules and recrystallizes into pure graphene!

Production Capacity & Capital Cost

A single Hyperion unit can produce 10 tonnes of pure graphene per year. As many Hyperion units as necessary can be added to scale up production. HydroGraph can manufacture a single Hyperion machine in two or three months and capital costs compared to capital required for mining projects that readers of this letter are familiar with are very modest, relative to revenues that are expected to be generated. Capital costs of $10 to $12 million can conservatively generate $100 million per year in revenues! That statement was made by the company’s President & CEO Kjirstin Breure in an interview posted on HydroGraph’s website. It is based on serious discussions the company has been having with various companies for various applications, some of which are of significant size. It is my understanding that the company has five Hyperion units in stock at this time of whch one is of commercial size. Management has also said it has a graphene inventory on hand measured in tons. It is used as required for testing by numerous companies for various applications. The company is ready to start producing and to scale up as soon as it starts receiving contracts for commercial production, hopefully with the next month or two.

With a C$3.6 million capital raise toward the end of 2024, Hydrograph is fully funded to begin producing commercial graphene this year and anticipates its first commercial contracts imminently. In fact, HydroGraph was anticipating its first contract in Q4 of 2024 from an auto manufacturer that was expecting a 5% improvement in the applications being tested. But when tests showed a 25% improvement, that company discovered something that HydroGraph implies is very positive but is unable to discuss it at this time.

Economics

The simplicity of the explosion production process plus the input costs of acetylene gas for producing 99.8% pure graphene combined with the massive value added to various industries for the company’s patented product leads to expectations of very high gross profit margins. In fact, the energy costs compared to competing producers of inferior graphene products is a tiny fraction of their costs. The lowest energy cost for any competitor is 68% higher than for HydroGraph. The company’s current facility is in Kansas but the company plans to move to Texas where it can tap into a pipeline for its acetylene gas, making even that low input cost even less expensive.

The manufacturing process is not labor intensive. The company currently has only 16 employees. Obviously that number will increase somewhat as the company scales up production, but the number of employees per revenue should be very low. Another economic factor that favors HydroGraph over competitors is its low energy usage.

The economics will vary with different industries, so Management plans to choose to supply industries with the highest value added from its graphene production, which will enable it to secure higher prices for its production. The cement industry for example, can benefit by using graphene because, being the strongest substance ever discovered, when combined with cement graphene can drastically reduce the amount of cement required to produce a cement with the same strength. But the margins in this business cannot match the margins for the plastics industry or presumably the auto industry, with which HydroGraph is in advanced discussions.

The following characteristics of graphene render the potential applications of pure graphene almost limitless. Graphene is:

200 times stronger than steel.

It is extremely flexible as it can bend and stretch to 120% of its original size.

Its thermal conductivity is 10 times that of copper.

It is impermeable so that all elements, even hydrogen, cannot penetrate its structure.

Its electrical conductivity is 1,000 times current capacity of copper.

Its electronic behavior is unique in that electrons can move at near the speed of light through it.

It is highly transparent.

Flame resistant

UV resistant

Extremely thin owing to its single layer atomic structure

Extremely stiff

Applications that have been tested are for lubricants, composites, coatings, cement/concrete, and energy storage.

I noted above that capital expenditures of $10 to $12 million can be expected to result in annual revenues of $150 million. It is my understanding that a gross operating margin (revenues minus direct operating costs but excluding general and administrative costs) of 80% may be well within reach.

Specific Applications

Plastics: The use of plastics contributes to multiple environmental issues such as pollution and CO2 production. By improving the mechanical properties of plastics using graphene as composites, plastic users can reduce usage without compromising performance. Results of tests showing dramatic improvement are reported in the company’s presentation.

Battery efficiency: Electrical conductivity of most electrodes needs to be improved for more efficient performance of batteries because any internal resistance is an energy loss. Results of tests showing dramatic improvement are reported in the company’s presentation.

Cement/Mortar: The cement industry contributes 8% of global emissions by humans. The use of graphene in cement improves mechanical strength, thus reducing the volume of cement used to improve durability and as such reduce carbon emissions. Test results also are reported on HydroGraph’s website.

Medical Applications: Lung cancer is the world’s deadliest cancer. The need to detect the cancer early is obvious and the use of graphene nano particles decorated with fluorescent protein as sensors can be read with a common fluorescence plate reader. Clinical trials in three countries have shown 90% efficacy in early detection of lung cancer at a cost of a COVID test! A company named Hawkeye Bio is currently shipping kits to U.S. clinics.

These are just some of the applications. I understand that the company has run tests for thirty different companies in various industries.

Commercialization Examples in Play

Large automotive company – Three successful trials have been completed for graphene integration into various automobile components. The company is anticipating pilot industrial scale-up order within one to two months, followed by commercial scale-up negotiations this year. Multiple tonnage volumes are anticipated.

The plastics industry – HydroGraph has had discussions with 3 PET producers. Initial results have been replicated by multiple parties. Given that PET plastics are used to package foods and beverages, testing by the FDA is ongoing. Upon FDA approval, which is expected within the next year, Management sees the potential for this application to exceed hundreds of tonnes of graphene per year.

Large energy storage company – Pilot industrial scale-up is underway based on reproduced results. Negotiations are expected to commence this year. Tonnage volumes are expected.

Aerospace - Management reports that an initial trial proved successful. Novel, precision engineered material is currently being tested. Material optimization tests are ongoing with formulation and scale-up anticipated in Q3 of 2025. Potential exceeds hundreds of tons.

Defense contractors - Initial trials on tactical fibers were successful. A second phase is underway with an anticipated six months of optimization before scale-up order. Orders for hundreds of tonnes are anticipated.

Composite construction material - Initial trial generated triple digit performance improvements. A second phase of testing is underway. Pilot scale trial expected to commence in Q2 2025.

University of Manchester UK – A key partnership to corporate connections and commercialization

Graphene was first discovered at the University of Manchester in the United Kingdom. As such, the university is the world leader in understanding the properties of graphene. Given that HydroGraph is the only company capable of producing pure graphene, it is quite natural that HydroGraph and the University of Manchester Graphene Engineering and Innovation Centre (GEIC) have formed a strategic partnership. The GEIC, at the University of Manchester, helps companies develop and launch new technologies, products, and processes that exploit the remarkable properties of graphene and other 2D materials. Because of the respect the world has for GEIC’s scientific expertise in this revolutionary materials science, it plays a major role in legitimizing HydroGraph to large corporations that it may otherwise have difficulty making connection with. GEIC is an invaluable application incubator for HydroGraph. And, it is important to note that James Baker, CEO of Graphene Manchester, is on HydroGraph’s Advisory Board.

Of course, in the end, as HydroGraph’s President Breure notes, it’s all about the data. I have passed along some information to you that sounds really good. But as always with startups, “the proof is in the pudding.” It seems that the most important “pudding” has already been revealed and is believable to investors who do some homework, thanks to the confirmation provided by GEIC’s independent certification of data. But for most market participants, the most important proof pudding will be the signing of a sizable contract with a major company. With something like 40 companies carrying out testing and/or investigating possible purchase of graphene from HydroGraph sometime in 2025, one or more contracts seem highly likely to be signed.

How Soon to Commercial Production?

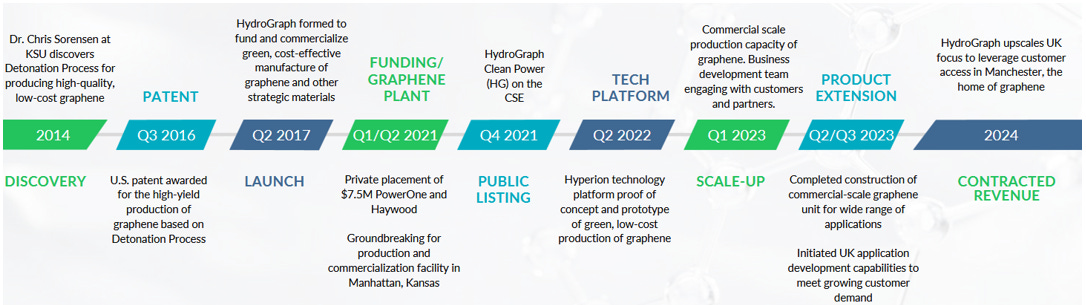

The timeline chart of this company’s history is shown above. You will note that the first contract and revenue was anticipated in 2024. But according to an interview Kjirstin Breure did just recently, which is available on YouTube, a higher-than-expected level of success with a major automaker delayed an anticipated contract before the end of 2024. The unnamed automaker was testing for two components and expressed the desire for graphene testing to improve those components by 5%. When testing revealed a 25% improvement, the automaker went back to the drawing board presumably to make some engineering adjustments. Thus, the contract was delayed and hopefully will be signed this year sometime. But as noted above, HydroGraph is working to a lesser or greater degree with 40 companies in the graphene hunt. So, 2025 should be the year when revenues for this company begin to flow and potentially dramatically so!

MANAGEMENT

Kjirstin Breure, President & CEO has a15-year background in emerging technologies and portfolio management, with experience in investor relations; on HydroGraph board since lab scale; Director of Operations for Frontline Crossings, and Chief Operating Officer with Omada Technologies.

Ranjith Divigalpitiya, Chief Science Officer – More than 25 years as a physicist; invented 3M’s graphene-like carbon coatings and contributed to 190 invention submissions and 20 granted U.S. patents. Authored more than 33 peer-reviewed papers and teaches at Western University, Canada.

Stephen Corkill, VP Operations – As former VP of Engineering, Stephen developed HydroGraph’s current production equipment and is building a working prototype for our hydrogen production as well. In his role as VP of Operations, he has evolved into commercial design and developing trade secrets for the business.

Matt Anderson, CFO – Over 15 years of accounting and CFO experience with private and public companies. He is the Managing Director of Malaspina Consultants Inc., where he has worked since 2009. Matt holds a Bachelor of Commerce from McGill University and earned his CPA, CA accreditation in 2008, providing CFO services to junior public companies across various sectors.

Chris Sorensen, VP, R&D – As the former Cortelyou-Rust University Distinguished Professor in the department of physics at Kansas State University, Chris invented the company’s Hyperion technology. He has seven patents and nearly 300 publications and is a fellow of the American Physical Society.

Stefan Bossman, Lead Chemist – A Distinguished Professor emeritus at K State. He received his B.S. and PhD in chemistry from the University of Saarland, Germany. Previous posts include postdoctoral research associate at Columbia University, an assistant professor, and subsequently an associate professorship in chemical and process engineering at the University of Karlsruhe, Germany. Stefan holds a PhD, has authored more than 200 publications, and holds 14 patents.

Board of Directors

David Williams, Chairman – Mr. Williams is an experienced global equities fund manager and corporate finance professional with 20 years’ capital markets experience. Mr. Williams was with M&G Investments in London from 2004 to 2019, in a variety of senior roles including Fund Manager of the M&G Global Recovery Fund from 2010 to 2019. In this position, Mr. Williams took an active role in delivery of the Fund’s strategy, which included significant involvement in investment decision making, fund raising, and corporate transactions. In 2019, Mr. Williams founded Richmond Bridge Capital that provides corporate finance advice to a range of small and medium sized, public and private companies and is a founder of UK-based investment firm Sankofa Investment Partners.

Kjirstin Breure, Director, President and CEO – See above.

Paul Cox – An independent director. Paul Cox has over 40 years of professional experience in engineered products for the defense, commercial wireless, and industrial markets. He started his career at Texas Instruments Defense Group (now Raytheon) and progressed to lead divisions of three public companies involved in designing and manufacturing engineered products. He was co-chair of the Technical Program Committee for the 1993 International Microwave Symposium (IMS) and is a Senior Member of the IEEE. Paul received his Bachelor’s in Electrical Engineering from Auburn University in 1980 and his MSEE from Southern Methodist University in 1984. He holds patent 5,302,958 for a “Low Loss, Fast Switching, Tunable Filter Circuit.” He is the Senior Director of business development for ST12 RF Solutions (a SWISSto12 company), where he enjoys solving RF and antenna problems with customers across the USA. In addition, he serves on the boards of Geronimo Solutions LLC and HydroGraph Clean Power, Inc.

David Morris – An independent director. Dr. R. David Morris is a distinguished dentist and accomplished entrepreneur with a proven track record of success. A graduate of the University of Toronto’s Dental Program in 2000, he quickly became a leader in both his profession and the business world. After purchasing a family dental practice in Lively, Ontario, in 2001 he grew the business over two decades before selling it to 123Dentist Inc. In addition to his dental career, Dr. Morris has built a diverse portfolio of companies under the Morris Group of Companies, which provides innovative solutions for the construction and resource sectors. The group’s operations span across Canada and South America, offering modular construction, workforce housing, site services, labor management, and safety training.

Career Milestones:

2007: Recipient of the NOBA Young Entrepreneur of the Year Award.

2008: Nominated for Canada’s Top 40 Under 40.

2004-2015: Founded and successfully operated Morris Modular Space Inc. in Sudbury, Ontario, which was sold to ATCO Structures and Logistics after 11 years.

2009-Present: Founded and operates Globe Modular Ltd., specializing in remote workforce housing and modular accommodations in Delta, British Columbia.

2009-Present: Founded 1783178 Ontario Inc. (Workforce), focused on strategic human resource consultation and supply for Canada’s mining, oil, and energy sectors.

2011-Present: Founded Morris Group Canada Inc., offering comprehensive site services for temporary and permanent workforce accommodations, including food services, facility management, and environmental solutions.

Dr. Morris is also deeply committed to fostering partnerships with First Nations communities, ensuring that the Morris Group of Companies brings not only industry expertise but also cultural sensitivity and collaboration to all business ventures.

Advisory Board Member

James Baker has had more than 25 years’ experience in the defense, aerospace, and security market, leading and managing high technology businesses, and is currently Professor of Practice at the University of Manchester and CEO of Graphene@Manchester, encompassing the Graphene Engineering Innovation Center (GEIC) and the National Graphene Institute (NGI). Responsible for business strategy development and delivery, including commercialization opportunities.

THE BOTTOM LINE

There is so much more easily understandable detail that shows the advantages that HydroGraph enjoys over its competitors. That doesn’t mean there won’t be any other graphene producers, but HydroGraph clearly has a superior product at lower costs than all other players.

You can kind of boil down the investment thesis for HydroGraph in the following six factors:

HydroGraph produces the highest performing graphene in the industry at industrial scale and at the lowest cost.

As a result of the company’s patented process, 100% of the graphene produced by HydroGraph is 99.8% pure, 100% crystalline, and 100% bonded pure 100% of the time.

The Hyperion System, the company’s production unit, uses the lowest energy in the industry and produces no waste. Its energy consumption, which is a small fraction of other graphene producers, is a major reason why its production costs are the lowest in the industry.

The company’s high-performance graphene can improve virtually every industry and has nearly unlimited potential impact.

As noted above, gross margins are expected to be very high, given the purity of the graphene and given the enormous value added from its use for companies that HydroGraph is currently talking with. Kjirstin Breure noted that, given its need as a small startup company, it will be choosing those companies with the greatest value added from its product, which should provide the heftiest profit margins.

A very low CAPEX relative to revenues generated and extremely large markets provides enormous upside growth for the company, relative to its current market cap of under US$50 million.

I would add another point, and that is a strong management team. Although quite young, the leadership of Kjirstin Breure has been quite impressive since attaining her role as President and CEO this past year. Her youthful enthusiasm is anchored by more seasoned engineers and scientists. The advisory board member, James Baker of the University of Manchester, is also a huge strength in importance of GEIC to HydroGraph’s future.

One concern I have had as I was learning about this story is that a major company could simply buy this company out at an early stage of this company’s development, which, for a large automaker for example, would be “chump change.” My friend Kerry Landis noted on the first page of this report said he shared that concern and that he has been assured that the Board is not at all interested in handing this company over to a predator, given the enormous growth potential that lies ahead. I believe this dream can become a reality. It’s certainly not more of a risk than most of the junior exploration stories covered in this letter, and with few exceptions, the upside seems to be far greater than that of most if not all current companies appearing in this letter. The story fits nicely in the energy and technology sector of our portfolio.

I strongly encourage subscribers to visit HydroGraph’s website and views some videos there that provides additional knowledge about this revolutionary material. This interview https://tinyurl.com/2cy3ngd8 of Kjirstin Breaure is very good as is this https://hydrograph.com/hydrograph-visual-media-guide/ presentation by various members of the HydroGraph team.

Share this post