I had planned to interview Chen Lin for this week’s podcast but technical difficulties from my end precluded me doing that. In stead, I chose to play my presentation on March 1, 2025 at the Metals Investor Forum in Toronto. I have chosen to to provide photos of each slide in my presentation so that you will have the benefit of seeing the slides that progress along with my talk. If you would rather watch the video, you can do so by clicking Gold is Money. Everything else is Credit

Slide # 1: Gold’s Rise Measures America’s Decline

Slide # 2: Gold is money. Everything else is credit.

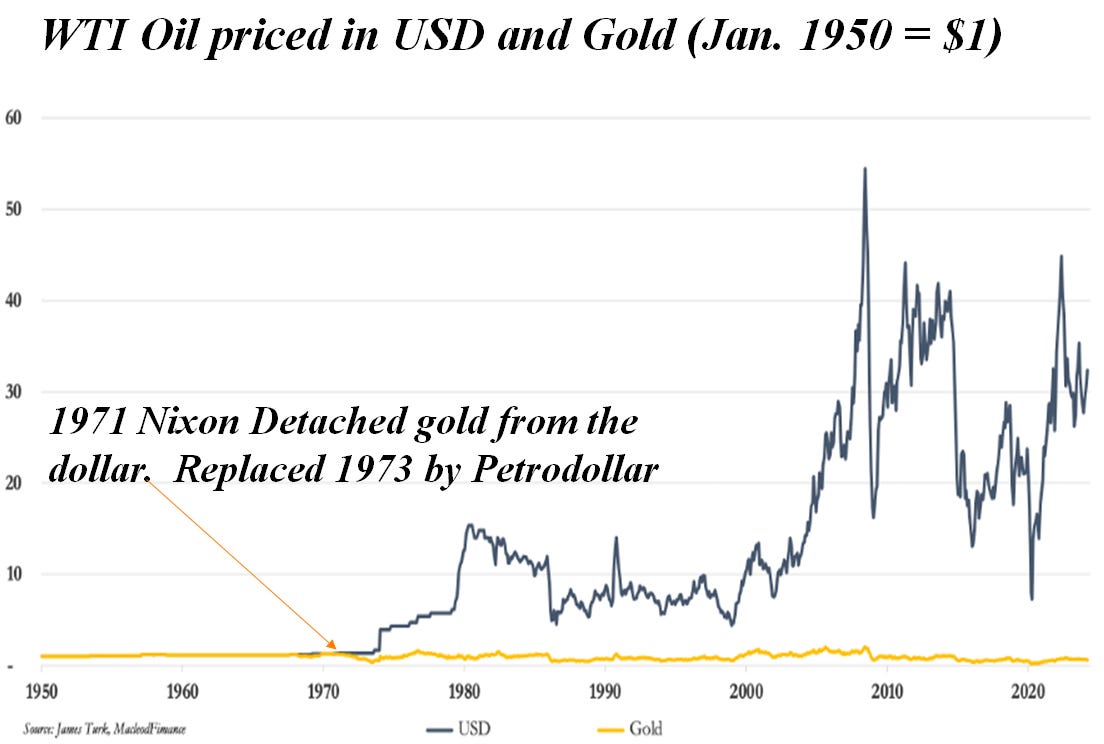

Slide # 3: Oil priced in actual money — gold has not changed in many decades

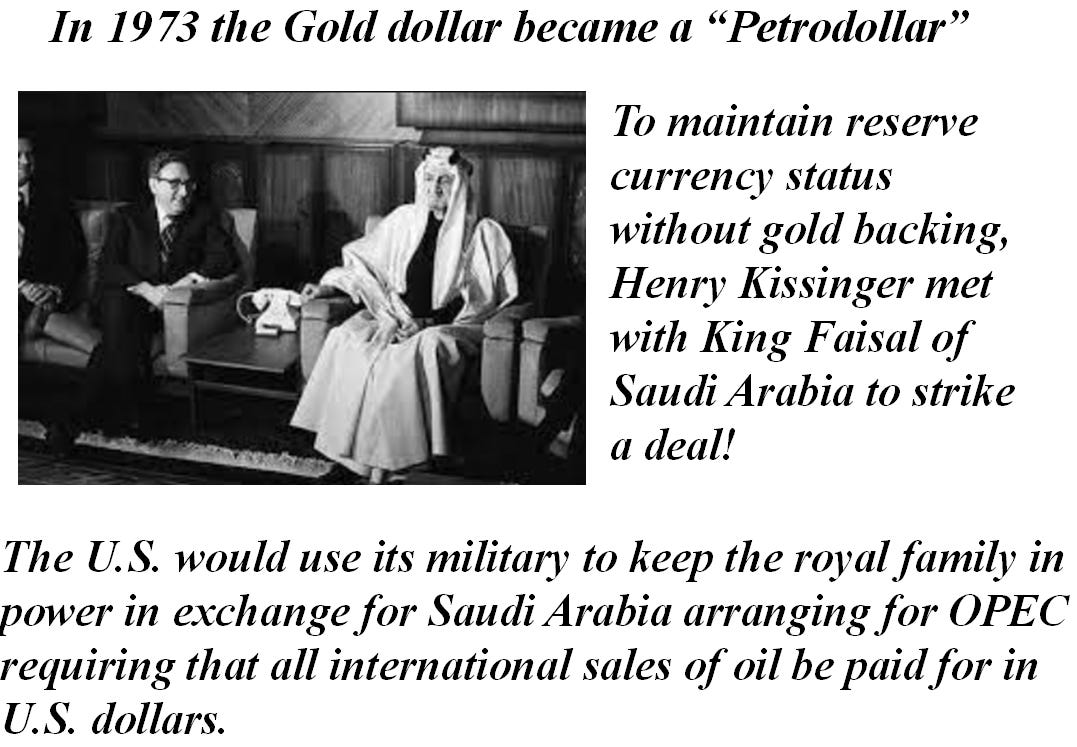

Slide # 4 After Nixon detached gold from the dollar, the U.S. required all international oil transactions be priced in dollars, thus putting a bid under the dollar and enabling the United States to own the world’s reserve currency with which if financed the expansion of its empire.

Slide # 5: But to own the world’s reserve currency the U.S. had to intentionally run massive trade deficits which meant wealth creating industries mining and manufacturing had to be sent offshore.

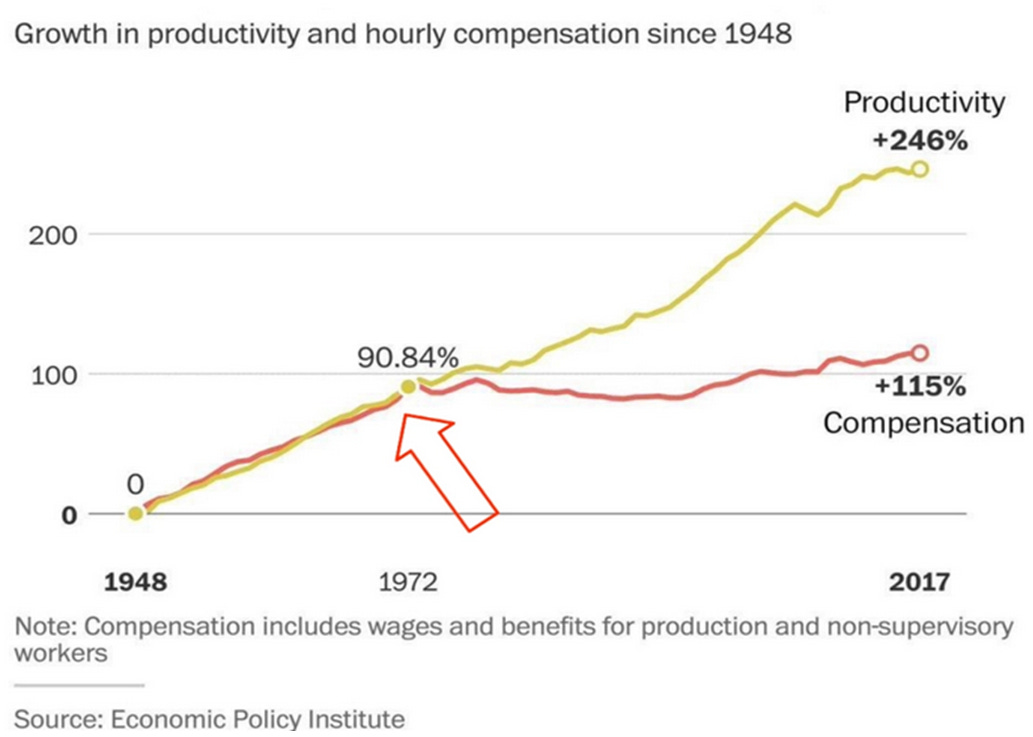

Slide # 6: The problem with offshoring wealth creating industries was that wage earners lost high paying jobs while corporate profits surged and non-wealth creating banking and government jobs grew dramatically.

Slide # 7: A vibrant middle class in the 1970s began to lose out on the American dream. By 2024, the top 0.1% of Americans owned $22.13 trillion in wealth while the bottom 50% of the population collectively owned a mere $3.89 trillion. The the top 10% of Americans in 2024 owned 60.6% of the country’s wealth. That level of wealth inequality which was the greatest since the 1920s, leads to political instability.

Slide #8: The massive decline of America’s middle class, not Vladimer Putin is the reason America has chose Donald Trump as its President even as massive propaganda campaigns funded by USAID were run against him. The hatred against this man nearly resulted in his assassination. By the grace of God, hatred failed.

Slide # 9: Trump’s policies are aimed at reviving a dying middle class by bringing back to America greater wealth creating industries like mining, manufacturing and technology.

Slide 10: Treasury Secretary, Bessent said, “America is not in a clean energy crisis. It is in an energy crisis.”

Slide 11: “Clean energy” is certainly welcome, but it has to make economic sense. Scare tactics, meant for the masses in order to control them are not taken seriously by former Presidents who buy extremely expensive beach front homes. Two clean energy companies I like a lot are Oklo Inc (small scale nuclear power) and Bloom Energy. Bloom Energy builds clean energy along with natural gas to ensure electricity is available on demand.

Slide # 12: HydroGraph Clean Power is the only company that can economically produce pure graphene, a newly discovered material that is arguably the most significant material discovery since scientists learned how to use silicon.

Slide # 13 The National Debt Clock is available for viewing real time on line. It keeps track of America’s devastating exponential debt trap with no apparent way out other than to revert to a gold based currency reset which is a prerequisite to the restoration of honest free market capitalism. As Matthew Piepenburg stated, “With interest expense now greater than defense spending, America is ipso facto in open decline.

Slide # 14 pictures the exponential nature of America’s interest expense related to its excessive debt used to fund the American empire and wasteful government spending.

Slide # 15 pictures the exponential rise in total U.S. debt that exploded higher during the First Trump administration in response to COVID 19. That was followed by continued out of control spending during the Biden Administration as a so called “Inflation Reduction Act.” Will Trump be able to save the Republic from total destruction and inclusion into a World Economic Forum Marxist/Fascist dystopia or is this inertia of a one world dictatorship unstoppable?

Slide # 16: Up until around the time of the 2008 financial crisis, the U.S. was able to live beyond its means because foreign savings were used to fund U.S. excess spending. But since then, net export countries have significantly reduced their purchase of U.S. Treasuries meaning that Americans themselves will have to service debt and have left to spend for themselves.

Slide #17: When the CIA overthrow of the democratically elected government in the Ukraine in 2014, that was the first significant inflection point for the decrease of foreign purchases of U.S. Treasuries. But the really big decline came after the Biden Administration confiscated assets from Russia and took away that countries use of the SWIFT international trading system, forcing Russia to move closer to China for its economic security. That move by the US also caused most nations outside of NATO to fear the U.S. might also seek to remove their sovereignty as well, leading to a very large number of nations turning hostile toward the U.S. and sharply reducing their purchases of U.S. Treasuries while at the same time building their gold reserves.

Slide # 18: A picture of escaping risk the dollar system by opting out of the dollars and opting into storing wealth in gold, the only true money known to humankind.

Slide# 19: The nations most at risk from an expanding U.S. empire formed a trading group of nations outside of the dollar system. Brazil, Russia, India, China and South Africa were the original BRICS nations. Since then five more have joined and many more are seeking to join. Collectively the BRICS members have a majority of the world’s population and rising levels of prosperity.

Slide #20: A couple of days after his confirmation as Secretary of State, in an interview with Megan Kelley, Marco Rubio reiterates Trump’s view that the U.S. needs to learn to live peacefully with other leading powers in the world and to spend its efforts in building its economy and trading with various countries around the world in a return to a mercantile system with each nation respecting the autonomy of another while engaging in self serving trade.

Slide # 21: Under the American empire, the U.S. financed its wars and clandestine government overthrows through the fiat dollar system that began in 1971 when Nixon detached gold from the dollar. By design the U.S. off shored wealth creating industries in favor of wealth consuming service industries. In the process, America weakened its economic standing as essential life preserving critical materials had to be purchased from countries that were increasingly hostile to America’s aggressive global expansion. The Trump administration is now seeking to restore essential mining and manufacturing to America which bodes well for industries seeking to produce commodities and manufactured goods. Companies that can produce essential products like critical metals will be prioritized including some mining companies followed in J Taylor’s Gold, Energy & Tech Stocks.

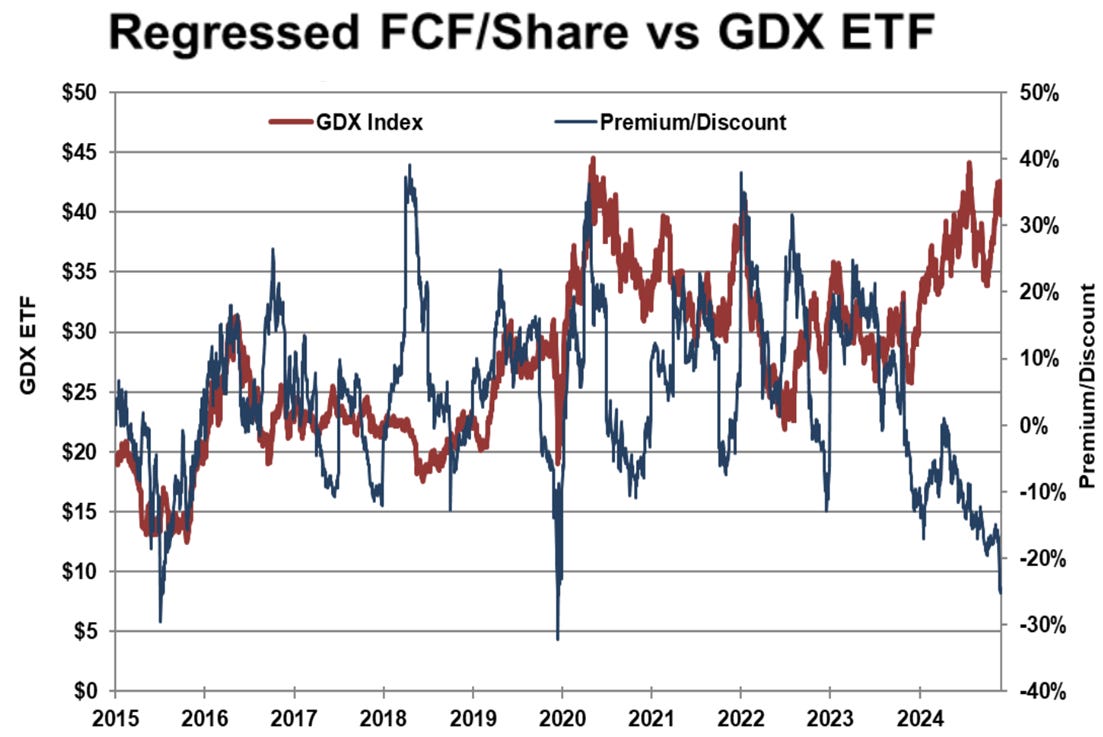

Slide # 22 While Gold has risen dramatically, the share prices of gold miners have lagged significantly behind the rise in the price of gold. However, miners are now starting to show very robust free cash flows from operations. I believe it is just a matter of time before the entire gold (and silver) mining sectors are among the top share price performers.

Slide # 23: Free Cash Flow (FCF) of the GDX companies is shown in Red. Note the dramatic rise over the last year. By contrast, the shares are selling at a more than 20% discount from the index FCF.

Slide # 24 The Magnificent 7 stocks recently had a combined market cap equal to 62.5% of the U.S. GDP. However, at this time it appears the U.S. equities may be heading into a bear market as the U.S. economy enters a recession. As the larger cap stocks begin to disappoint, might we expect a mass exodus out of past favorites into the gold miners that are starting to generate huge cash flows?

Slide# 25: Just this past week, the Atlanta Fed which attempts to keep track of GDP in real time, suddenly calculated that the U.S. will experience negative growth in Q1 of 2025.

Slide # 26: Usually, retail investors pile into stocks most aggressively as equity markets are peaking. That seems to be happening now. Not shown here but widely understood is the fact that corporate insiders have been net sellers of their shares over the past year. If history is prologue, this suggests we are likely beginning an equity bear market.

Slide # 27: With the exception of the stagflationary 1970s, investors who had 60% in stocks and 40% in U.S. Treasuries enjoyed protection from equity declines by rising Treasury prices as inflation rates declined. But as in the 1970s when bonds were in a bear market, over the past 4 years, U.S. Treasuries have not been a safe haven while gold has performed extremely well.

Slide # 28: By all accounts, America is now in its 4th Fourth Turning. A fourth Turning is a period of four generations or 80 to 100 years. Major changes in the values of society occur with major changes taking place in Fourth Turnings. The current turning is America’s 4th Fourth Turning. The big question is whether American can retain the basic values of its First Turing, that being its U.S. Constitution as written in 1776 or are we heading toward the more normal tyrannical dictatorial regimes that have made lives very dark for most humans throughout history?

Slide # 29: Which way will we go in the Fourth Turning? Throughout human history, the most common forms of government has had a ruling elite dictating policy from the top down. That form of government is depicted below on your right where government does what it wants which ends up imposing pain on the masses. The American Constitution was based on the notion that we are endowed by our Creator with the right to be free to use our God given talents to serve each other, not a king or despot. The cartoon below was created by philosopher Ayn Rand who suffered under the communist dictatorship of the Soviet Union. She adored free market capitalism as espoused by America’s Founding Fathers because it is a system that rewards success but requires the individual to be accountable for its failures, unlike dictatorships that passes mistakes on to innocent citizens.

In my talk I voiced optimism about the future in part because a growing number of open minded thinkers who formerly thought of themselves as Democrats have exited that party due to its recent extreme WOKE Marxist inclinations that are an anthema toward traditional American values. Elon Musk was among the first reknown accomplished capitalists to wake up to the dangerous direction we have been heading. Most recently Jeff Bezos, the owner of the previously left leaning, military industrial complex, CIA loving Washington Post has mandated the editorial page of that paper discontinue its left leaning biased propaganda and permit diverse views to be published in keeping with the First Amendment to the U.S. Constitution.

No matter your philosophical views, from an investment perspective, the direction of policies under the Trump administration appears to favor Main Street over Wall Street and the private sector over government. Especially mining, manufacturing and technology appear to have a bright future.

Best wishes,

Jay Taylor

Share this post