WE HAVE A BIG PROBLEM!!!

The solution to this problem is when gold shares will really take off!

The following article appeared on X from By No Limit @NoLimitGains. I believe “No Limit” is right about his predictions though timing for the ultimate event may be impossible to predict. The parabolic move for gold and silver indicates it can’t be too far into the future. Please read and ponder what “No Limit Gains” is saying here:

“Gold is ripping while stocks are at all-time highs… That almost NEVER happens, and it rarely ends well.

“Gold is up 67% YTD, nearly 10 times its average yearly return… insane. Every investor should be paying attention.

“Here’s the BIG problem: Historically, gold moves against risk assets, not alongside them. When equities are making new highs, capital is usually chasing growth, not protection.

“Gold tends to lag, or even drift lower but that’s not what’s happening now. Stocks are pumping like crazy and yet gold is breaking out anyway. That tells you something very important: This setup has shown up before, and it usually ends badly.

– In late 1999, equities were flying while gold quietly based.

– In 2007, stocks were near highs while gold kept catching bids.

– In both cases, gold wasn’t early by accident, it was early by necessity.

“Gold doesn’t front-run growth, IT FRONT-RUNS STRESS.

“What makes this worse is who’s buying… This isn’t retail chasing a quick trade. Central banks have been accumulating gold at a pace we haven’t seen in decades. Governments are buying massive amounts of gold. In fact, China purchased $1 billion worth of gold in just 30 days.

“They’re reducing exposure to long-dated debt, fiat risk, and currency volatility. They’re not hedging or diversifying. They’re positioning for the global monetary reset.

“Meanwhile, equity markets are priced as if nothing can go wrong. When stocks and gold rise together, it usually means one thing. Risk is being mispriced.

“Either gold is wrong, or equities are. History says equities are the one that eventually reprice. This is a warning that the shock, when it comes, won’t be small.

““If you’re fully allocated to risk and ignoring this, just know you’re not early in whatever stock or coin you think will 10x.

“Btw, I’ve been studying macro for the last 22 years, and I’ve called every major market top. When I officially exit all markets, I’ll post it here for everyone to see. If you still haven’t followed me, you’ll regret it.”

Disclosure: I have no idea who @NoLimitGains is, but he has more than 128,000 subscribers and when someone who is an independent thinker like No Limit is and has a following of this magnitude, it may be worth paying some attention.

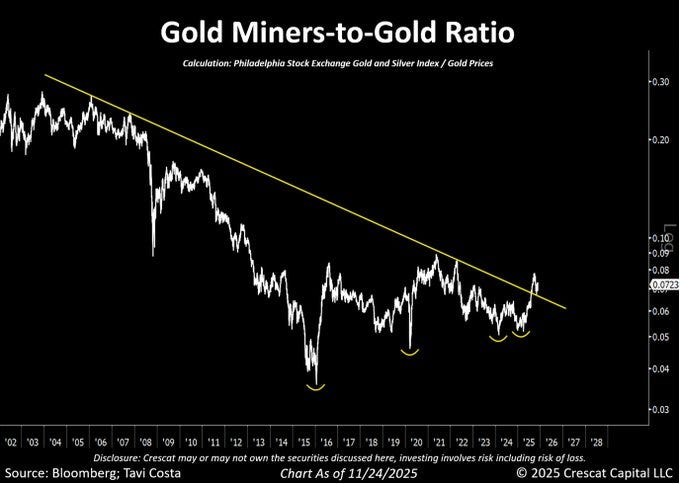

The following chart which I am also displaying on today’s “Headline News” article is from Tavi Costa of Crescat Capital. 2025 has been one of the best years for J Taylor’s Gold, Energy & Tech Stocks, but as gold mining shares are just now starting to respond to a $4,400 gold price, 2026 looks like it should the best year yet this newsletter will have in its 39/40-year history, especially if NoLimt Gains is correct. History shows that gold really takes off as equity bear markets get underway. What better time than now to subscribe to J Taylor’s Gold, Energy & Tech Stocks?

Best wishes for a Merry Christmas and a happy and healthy 2026.

Jay Taylor

Every financial mania through history ended in financial collapse and this particularly extreme example will too no doubt. Given that all currencies are now fiat collapse characterized by price inflation is the sound bet. Tangible assets will provide refuge, as has always been true, particularly liquid tangibles (i.e. precious metals).