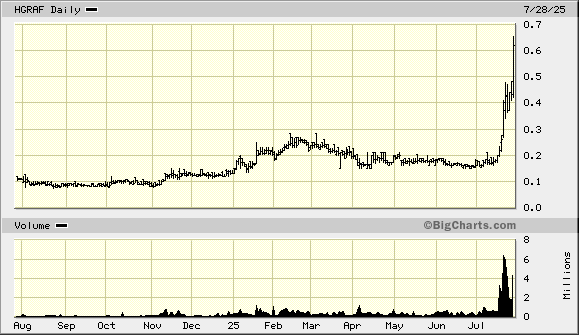

Could Hydrograph Clean Power Be as Big as Nvidia?

The key to a "possibly yes" answer is understanding the science of Hydrograph's unique synthetic graphene

On X, one follower recently mocked my views on Hydrograph Clean Power by a couple of weeks ago when the stock was still below my recommendation price of $0.16, headlining a tweet with something like “Jay’s 30-Year Clown Show Continues.” I responded by admitting I have had some duds, actually over the past 40+ years. But I also pointed out that I have had my share of 10+ baggers. And I would remind my friend that one 10-bagger can make up for 10 investments that lose 100%. I don’t believe I have had as many as 10 companies that lost 100% over the years. But quite frankly, there are no mining stocks in the world that can match the wealth-creating capability of a science technology company that is changing the world in a meaningful way. In a recent interview Hydrograph’s CEO Kjirstin Breure did with Kevin Bambrough, she said something to the effect that “Hydrograph Clean Power having the patented process to produce pure graphene is like being the company that discovered the existence of oil and having the only oil drill on the planet!

Hydrograph’s patents not only to enable it to produce the only 100% pure graphene on the planet with anticipated exceptional operating margins of 70% is indeed like “discovering oil and having the only oil rig on the planet.” But it gets better than that because Hydrograph Clean Power is an innovative materials science technology company, not just a producer of a single commodity.

To get an idea of why graphene has emerged as one of the most promising nanomaterials on earth, you have to understand its properties, some of which are the following: it is not only the thinnest but also one of the strongest materials; it conducts heat better than all other materials; it is an excellent conductor of electricity; it is optically transparent yet so dense that it is impermeable to gases—not even helium, the smallest gas atom, can pass through it.

Graphene is not Graphite.

A few years back, around 2015, not many years after graphene was discovered at the University of Manchester in the U.K., graphite and graphene were hyped up stories in venture capital markets. The unimaginable potential of graphene understandably excited investors. And the reason graphite exploration excited investors was because the discovery of graphene (1 carbon atom thick) was made at the University of Manchester by literally peeling layer after layer of one atom thick graphene from a chunk of graphite with scotch tape.

There are companies that produce so called graphene, which has been defined by graphene scientists as being comprised of 10 or fewer layers of carbon one atom thick. The cost of pulling layers of carbon from graphite is extremely expensive. Moreover, very few companies that call themselves “graphene” companies even get close to that level of purity, and those that have achieved it are unable to providing consistency in the molecular composition of their graphene. That is one reason why investors have largely given up on their graphene investments. The promise of this amazing material has failed to live up to the hype. Hence, the skepticism regarding Hydrograph Clean Power. Thanks to people Hydrograph’s CEO Kjirstin Breure, nuclear engineer Kerry Landis both of whom I have interviewed and more recently Kevin Bambrough who I plan to interview in the near future, judging by share price appreciation, Hydrograph Clean Power skepticism is about to end. Hydrograph holds the patent to produce 100% pure graphene with 100% certainty continuously using its patented detonation process. No other company can legally compete with Hydrograph which is consistently producing the perfect graphene that is enabling the promises that so excited investors a decade ago actually come true!

But Hydrograph is not just the lone producer of graphene. The most exciting part of this story is that Hydrograph is first and foremost a technology company! The patent that Hydrograph holds to produce its pure SP2 bonded graphene, is comprised of 99.8% carbon and 0.2% oxygen by detonating acetylene gas inside an iron tube. It holds the patent for that process through 2036. If that were all the company was prepared to do, with 70% operating margins and very low capital costs, assuming a successful execution of is its business model, you would be justified in projecting a hugely profitable company. Its margins would be far better over the life of its patent than anything you see in the mining industry because mining companies over a 10- or 11-year mine life.

But Hydrograph is far more than a producer of pristine graphene, which others companies will be able to produce once its patents expire in 2036. Scientists at the University of Manchester as well as at Hydrograph have been discovering innovative ways to tailor its pristine graphene to meet specific needs of industries. Often with materials innovation there are tradeoffs. For example, one material may give you more strength but be more brittle. What graphene scientists have discovered is that by placing layers of Hydrograph’s pure graphene on top of one another they can sometimes engineer desired properties without needing to sacrifice others. As Hydrograph continues to work with major companies as well as the U.S. military in engineering specific properties to meet the needs of industry, it is continuing to patent those engineered products. In other words, Hydrograph has a growing patent portfolio that can be expected to continue to grow to meet the needs of some of the largest entities in the world, the biggest of which is the U.S. military. That’s why Hydrograph is not just a producer of graphene, a commodity, but is an innovative materials science company taking advantage of various applications of its SP2 bonded graphene. As noted above, pure graphene is not only the thinnest but also one of the strongest materials; it conducts heat better than all other materials; it is an excellent conductor of electricity; it is optically transparent, yet so dense that it is impermeable to gases—not even helium, the smallest gas atom, can pass through it.

The following graphic is displayed on Hydrograph’s website, showing just six industry categories in which various large-scale companies have been testing and nearing contract negotiating time.

At the top of this article I showed a stock chart for Hydrograph Clean Powers’ share price. I saw one person complain on X that he should have been told about this story when Hydrograph sold at $0.16. Well, actually, I did tell my subscribers about it at $0.16 in my January 3, 2025, weekly newsletter. I give credit to a 20-year subscriber, Kerry Landis the nuclear engineer, for telling me about it toward the end of 2024 because he felt NOW was the time that the company was about to begin an explosive growth phase. So, giving credit where credit is due, Thank you, Kerry!

So, the real reason I am pounding the table for this story now is because the company is getting very close to the time when contracts with some of the 60+ companies Hydrograph has been working with to test materials will have to fish or cut bait. By that I mean it’s getting very close to contract signing time. Kjirstin Breure has talked about an 18-month product development cycle in which Hydrograph works with companies to test applications of a specific graphene product to improve the products of Hydrograph’s clients. Kjirstin explained to me that these 18-month cycles occurred “Mostly because the first pilot tests take 3-8 months and then industrial testing takes almost a year. At that point we move to contract negotiations, and exactly as you’ve mentioned, we are just approaching that point with a few customers.” The direction of the company changed from a model in which it was going to rent out its Hyperion units to the current model of producing and engineering graphene products for specific customer needs. Kjirstine has been CEO for only about 1 ½ years.

Last year Kjirstin noted that an unnamed automobile company had tested Hydrograph’s graphene hoping for a 5% improvement in whatever that unnamed application was. When the result was a 25% improvement, you might wonder why that wasn’t enough to earn Hydrograph a contract. Why did nothing come of that contract last year? I trust Kjirstin in explaining that very large companies take considerable time to make decisions. I’m sure those of you who are more skeptical may be sympathetic to the investor who referred to my work as “Jay’s 30-year clown show.” I can hear the members of that club say, “Taylor, you won’t name the company. You won’t even name the part of the car that Hydrograph’s graphene was tested on. Why should I take you seriously?”

I can’t rebut that argument. The proof will be in the pudding and dozens of companies that have passed through pilot testing and have conducted industrial trials are nearing the end of that 18-month cycle. As Kjirstin told me, in 2026 “there should be a lot (of contracts) to announce in 2026.” She also said in the most recent interview I did with her, posted on my YouTube channel, that there may be some smaller contracts that are announced this year. That is the reason owning at least a few shares of Hydrograph Clean Power is essential NOW! At some point when Management announces the first contract, especially if it is with a major company, I’m guessing that at least some of those members of the “Jay Taylor’s Clown Show Club” will revoke their membership and buy shares. If/when the masses understand that Hydrograph is no clown show but a very serious technology company with the ability to improve products from almost every materials producing industry imaginable, the move in these shares over the past couple of weeks will be child’s play by comparison.

Certainly, Hydrograph will have to perform or my excitement for this company will morph into an embarrassing concession that my excitement over the company’s future was more of a fantasy than a reality. If you are afraid of losing or being embarrassed, you forfeit life’s upside potential. Because I believe Hydrograph not only has 10-bagger potential but also, as Kerry Landis and Kevin Bambrough have suggested, 100 bagger potential or more, In my view, you owe yourself and your family some effort to understand why Hydrograph provides may be a once-in-a-lifetime generational wealth-creating opportunity. To start with, go here https://www.miningstocks.com/archive/hotlines/90998736/hotline-2025-01-03.pdf to read my initial report on Hydrograph Clean Power published in my January 3, 2025, weekly letter.

After you read that, you can listen to the March 1, 2025, Hydrograph presentation by CEO Kjirstin Breure at the Metals Investor Forum here:

followed by my interview with Kjirstin in Toronto on that same day here

On March 26, 2025, I interviewed Kjirstin primarily to confirm the anticipated economics of the Hydrograph Clean Power business model. I just wanted to make sure I heard and had understood a prior interview she had conducted because it sounded almost too good to be true. Watch here:

Then On July 7, 2025, Bob Moriarty joined me as co-host to interview Kjirstin during which time Bob compared the breakthrough detonation technology used by Hydrograph Clean Power to that of the transistor and the silicon chip that followed. This was a fascinating and entertaining video that helps investors broaden their understanding of the enormous number of potential applications that this company’s pure graphene has as well as the extremely robust economics of the company’s business model. Watch here:

Then on July 17, 2025, I interviewed Kerry Landis, the nuclear engineer who introduced me to Kjirstin Breuer and Hydrograph Clean Power. Kerry talked about the vast material capabilities of Hydrograph’s pure graphene and he also laid out exceptionally robust economic prospects for the Hydrograph business model here:

Kerry walked me through the economics of the company’s business in which Management is conservatively projecting operating margins of 70% on thousands of tonnes of annual graphene sales with low-end sales at a minimum of $250,000 per tonne. With operating costs of 20% (seems reasonable when adding in syngas byproduct sales), a profit margin of $200,000 per tonne is calculated. Multiply that times 25 tonnes per year and each Hyperion unit would generate operating profits of ~ $5 million per year on a unit with a ten-year life that costs $500,000 to build. It’s important to note that these Hyperion units can be scaled up to any number required so that 5 units with capital costs of $2.5 million would generate $25 million in operating profits per year. You can play with the math. But if you listen to my discussion, you can hear the logic behind Kerry’s vision of how even at a very low PE ratio of 10 times, Hydrograph becomes a multi-billion-dollar market cap company compared to its market cap of about US$ 45 million when our interview took place. The price then was around US$0.16; it’s now $0.43. But once you grasp why this company’s sales are expected to explode higher with more energy than acetylene exploding in the company’s Hyperion units, and why this is a technology company rather than a commodity company, you can understand Hydrograph’s enormous potential to impact virtually every existing industry that exists, including the defense industry which may be the biggest of all. Once the first contracts are signed, skepticism will be removed. I suspect many of the fans in Jay’s 30-Year-Old Clown Show Club will be silenced and those who buy at current prices will enjoy greatly enhanced portfolios.

The shares of Hydrograph really began taking off when on Kevin Bambrough, well known Toronto based financier and former CEO of Sprott Inc. has gotten behind Hydrograph in a major way buying millions of shares of the stock and doing a deep dive into the science and economics of the Hydrograph business model. Kevin is taking the story to numerous other investors and educating the world to Hydrographs phenomenal potential. He is also taking this story to numerous other high net worth investors in the technology space. I highly recommend you view this interview that Kevin did with Kjirstin that began airing at July 22 here.

Keven has also more recently interviewed Dr. Chris Sorenson, the scientist at Kansas State University that owns the patent behind the process used by Hydrograph to produce the only pure SP2 bonded fractal graphene on the planet. To learn why the unique properties of Hydrograph’s graphene holds the potential revolutionize virtually every materials industry in the world, I recommend you watch Kevin’s interview with Professor Sorenson here.

Finally, by the end of the week, I’m hoping to interview CEO Kjirstin Breure and the above named nuclear engineer Kerry Landis together to help lay people understand the unique properties of Hydrograph’s graphene and examples of how it can revolutionize industry.

My recent focus on Hydrograph does not mean I am ignoring the gold and silver mining sector. Indeed I am more excited than ever about gold and silver miners. But along comes Hydrograph which in my view has far more upside than any of the gold miners I am following. That said, I firmly believe the U.S. dollar is in the twilight of its existence as he World’s reserve currency as the dollar and all fiat currencies are suffocating themselves with levels of debt that can only be paid through the first hyper-inflating their currencies away. Interesting though is Kevin’s recent remarks to me that Hydrograph’s graphene is likely to be a powerful deflationary force. I hope to explore that topic as well with Kjirstin and Kerry.

Best wishes,

Jay Taylor

Jay Taylor

Thank you Jay !! You have done a great job on keeping us abreast

Could you please ask about FDA trial for plastics? Also could customers be required to put a 10 -20 % deposit down on contract orders?

Jay, "I'm old enough to remember" one of your recommendations gone bankrupt, McKenzie Bay windmills, but Hydrograph will more than make up for that x100.. Keep up the great work.