Business: Cerro de Pasco Resources is developing and readying for production what is likely the largest above ground silver resource with massive quantities of lead, zinc, and copper, plus gallium, an essential metal that is produced almost entirely by China. Longtime subscribers will remember that Cerro de Pasco, the brainchild of Guy Goulet, was covered in the past in this letter. But Covid 19 delays and other complications of a law in Peru that enabled the company to explore and produce from tailings, the company’s efforts were stalled for two years. Just recently a new law was passed that enabled the company to begin drilling the tailings deposit, and the results were significantly better than the estimated past resource noted above.

When the Peruvian law was passed that enables Cerro de Pasco to access and process the tailings deposit, the company received another shot in the arm with an investment from Eric Sprott, which makes him the largest individual shareholder at 14.7%.

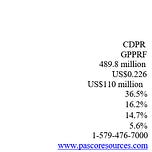

Management wasted no time in beginning to drill the project and on December 3 it announced the results from 177 assays from those nine holes are shown in the table below. management announced results from the first nine holes, the location of which are displayed by the geen dots in the illustration below

From those first nine holes of the forty holes in the current drill program some 177 assays were reported the average of which is set out in this table.

Assays from the remaining 31 holes are expected to be reported before Christmas.

Deeper into the tailings, values are higher. Around 1907 when J.P. Morgan built the biggest mine in the world metallurgical recoveries were not nearly as high as they are today. So between around 1907 through 1920 a higher percentage of metals were left behind in the tailings. Non-the-less, when I did a quick analysis of the values show above excluding iron, I found per tonne value of ~ $140 per tonne. Even with underground mining situations, those kinds of values are often very desirable. But with a tailings project when there are no mining costs, profit margins should be beyond robust.

When legendary mining investor Eric Sprott learned about Cerro de Pasco and after the company gained permission to explore and mine the tailings he came into the picture in a major way. He currently owns approximately 13.9% of the company.

Cerr de Pasco was covered in J Taylor’s Gold, Energy & Tech Stocks a few years back but when the project was tied up many years with red tape and Covid 19 I decided to skip out of the investment. But now that there appears to be a great light at the end of the tunnel, I have recommenced coverage in my letter.

On Thursday, December 5, I interviewed Guy Goulet and Chen Lin who has been one of the earliest supporters of Guy Goulet’s Cerro de Pasco dream of not only capturing the immense metal values in the tailings in the Peruvian city of Cerro de Pasco but also remediating a significant health problem by removing the sulfide tailings from the inner city.

I hope you will listen to my interview with Guy Goulet bottom left and Chen Lin bottom right.

Best Wishes,

Jay Taylor

Share this post