A Soft Landing? Are you Kidding?

The U.S. is facing a slow moving fiscal crisis for the first time in decades!

The equity and long dated US Treasury markets were cheered last week by a reduction in U.S. inflation in October and news suggesting to some that the Fed is done hiking interest rates. Whoever thinks that is not realizing that the Fed doesn’t control rates, especially longer-term rates.

The core consumer price index, which excludes food and energy costs, increased just 0.2% in October from September, according to government figures. Economists favor the core gauge as a better indicator of underlying inflation than the overall CPI. The latter was little changed, restrained by cheaper gasoline. The market was quick to conclude that the new data on Tuesday lends even more weight to recent comments by Fed policymakers indicating they may be done raising rates. And wishful Wall Street investors are quick to suggest this news shows the genius of Chairman Powell’s strategy over the past two years for bringing the economy in for a soft landing.

A soft landing? Are you kidding me? As Lyn Alden pointed out in her November 12 issue, “The U.S. is facing a slow-moving fiscal crisis for the first time in decades. We’re running 7%-of-GDP deficits despite unemployment rates being very low, and since we are no longer in an environment of structurally falling interest rates, interest expense is starting to become a problem for the first time in decades!” The operative phrase here is “slow-moving-crisis.” But what happens next year to the U.S. deficit to GDP as high interest rates start to bite hard, consumers are tapped out on their credit cards, corporate profits plunge and unemployment skyrockets.

For now, things seem to be chugging along okay with major stocks continuing to hold up the major indexes so Wall Street can pretend all is alright. But underneath the façad of rising prices are growing problems of too much debt taken on when the cost of borrowing was virtually free. Watch the commercial real estate market, which I believe is about to suffer cascading defaults as offices remain empty and real estate companies are forced to pay much higher interest rates. And then there are growing geopolitical issues that actually factored into Moody’s decision to lower the U.S. Treasury debt rating. Call it a soft landing if you want. But the writing is on the wall for a much tougher 2024 than 2023.

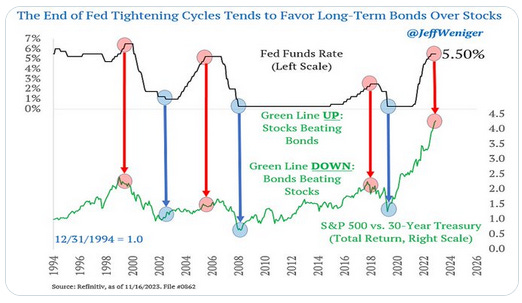

So, what safe havens are available for wealth preservation? Jeff Weniger tweeted the chart on your right, noting that “over the last 3 decades, the end of Fed tightening cycles has been great times to rotate from stocks to bonds. We can see it clearly in 2000, 2006, and 2018. Tough chart to fight.”

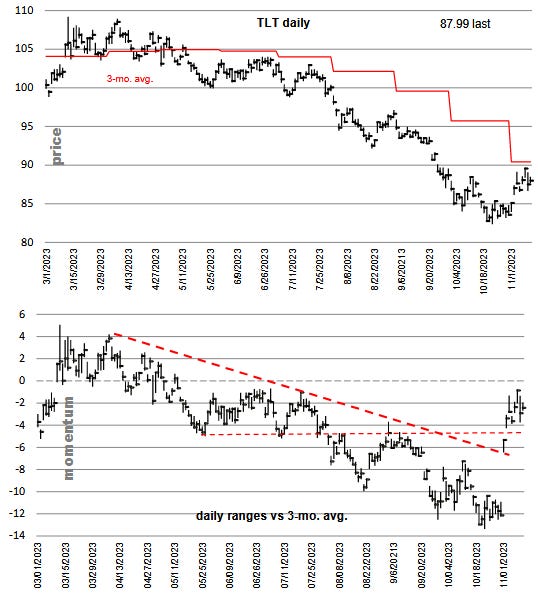

Obviously, Michael Oliver’s momentum chart of TLT, the long-dated U.S. Treasury ETF, has shown an upward explosion over the past few trading sessions. But Michael sees this rise in the long-dated Treasury as simply a counter trend rally. Yes, as Lyn Aldin pointed out in her Nov. 12 letter, the reverse repo markets are currently providing a source Treasuries funding that has offset reduced liquidity from QT. But that source is declining dramatically. Oliver’s work clearly points to TLT’s rise as a counter-trend rally. And again, as Lyn Aldin noted, “The U.S. is facing a slow-moving fiscal crisis for the first time in decades.” Our debt/GDP is over 120% and is apparently out of control. And when a handful off Republican legislators express concern they are immediately laughed at. The fact is that interest rates have to rise a lot higher before the Treasury can be funded, assuming as I do that endless fiscal expenditures accompanied by a Fed that continues to ensure no shortage of liquidity will lead to a more serious bought of inflation than the one of a year ago.

So interest rates must rise meaning that US Treasuries must decline.

But if Treasuries are not the place to preserve wealth, then were is one to go? Michael Oliver turned solidly bullish on gold a few weeks back when the yellow metal’s monthly momentum rose above the 3-month moving average. Silver did the same on November 15, as it rose credibly above the key number, which was $23.27 to $23.53 on Nov. 15. It closed this week at $23.85.

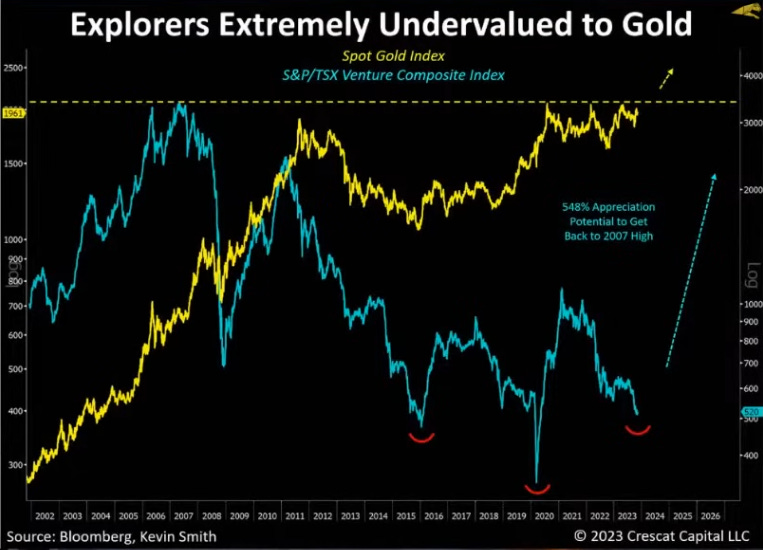

And what about gold exploration stocks? They are as depressed as any time in the 42 years since I have been authoring J Taylor’s Gold, Energy & Tech Stocks. The chart below makes my point about just how depressed the junior gold exploration sector is at a time when gold and silver are preparing for the next gigantic move higher.

As gold (yellow) gets ready to break though the old highs into the bright blue yonder, the S&P/TSX venture index is putting in a very bullish inverse head and shoulders pattern. The shares would have to appreciate 548% to reach its high relative to gold that took place 15 years ago. All the factors appear to be lining up to suggest the next major move in the gold and silver mining shares is drawing near.

You may want to consider subscribing to J Taylor’s Gold, Energy & Tech Stocks where we are following quite a few emerging multi-million ounce world class gold mines that should rise many fold from current depressed levels. Its always hard to find many who want to buy depressed classes of assets. But then they are not usually among the top performing investors. The legendary Bernard Baruch explained that he became wealthy by buying stocks that no one else wand and then selling when everyone wanted them. Timing for applying that investment philosophy to gold shares has never been more appropriate than now.

Best wishes,

Jay Taylor

George is not wrong in noting my failures. What he is missing are the large number of closed positions that gained over 100% from the early 1980s to the present. I am in the process of compiling them in response to George. Mineral Exploration is a high reward/high risk business. In good years gains are plentiful. In down years for gold, not so much. Soon to come will be a list of gainers exceeding 100%. Stay tuned.

Without a doubt, the WORST newsletter I have ever subscribed to.

Some of his now-worthless gems: ThermoTech, Itronics, Delgratia, Internl Prec Metals, Lyon Lake Mines, Formation Capital, Corp Lithos.

These were all "highly recommended" and touted in Jay Taylor's weekly phone updates and in the newsletter. LOL.