Lahontan Gold has a paltry market capitalization of ~US$5 million. It’s last quoted at ~ US$0.02 and has a measly market cap of ~$5 million.

The company’s Santa Fe formerly producing gold mine has a NI-43101 gold resource nearly 2 million ounces of open pit gold and a very competent 5% discounted pre-tax Preliminary Economic Assessment (PEA) of $265 million. So, the market is pricing this asset at just $5 million!? Santa Fe’s after tax 5 % discounted PEA stands at $200 million or 40 times its current market valuation.

So why is Lahontan Gold selling as if the company were nothing more than an empty public corporate shell? As an owner of these shares since March, 2023 when I bought them at $0.12, I have been asking myself that question. Could there be an explainable quirk in the market that has mispriced this company’s Santa Fe asset at such a steep discount?

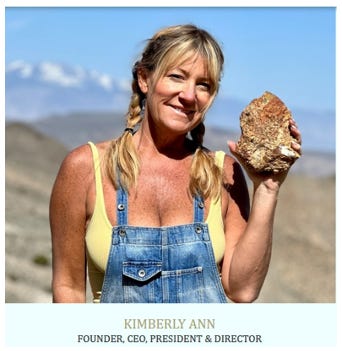

Kimberly Ann, the CEO of Lahontan and Brian Mahar, the company’s chief geologist answers that question in the affirmative in my 25-minute interview recorded on February 6. I truly believe from the current price of these shares a 10-fold gain or much more is a very real possibility. By the way, the Kimberly and Brian team have had past merger and acquisition successes in the past from developing mineral projects for acqusition. Its not difficult to immagine the company’s prjoject located in mining friendly Nevada will be desired by any one of several mid tier miners as Kimberly and Brian advance the project toward production.

I have personally owned this stock since I added it for coverage in my newsletter in since March 2023 at $0.12. The only incentive I have in airing this interview stems from my desire to share this opportunity with you and in the expectation that informed investors will begin placing bids on this intrinsically undervalued company.

From my perspective selling Lahontan now would be a moronic decision. If you listen to Kimberly and Brian’s discussion of Lahontan and their plans for 2025, I’m guessing you will agree.

Best wishes,

Jay Taylor

Share this post